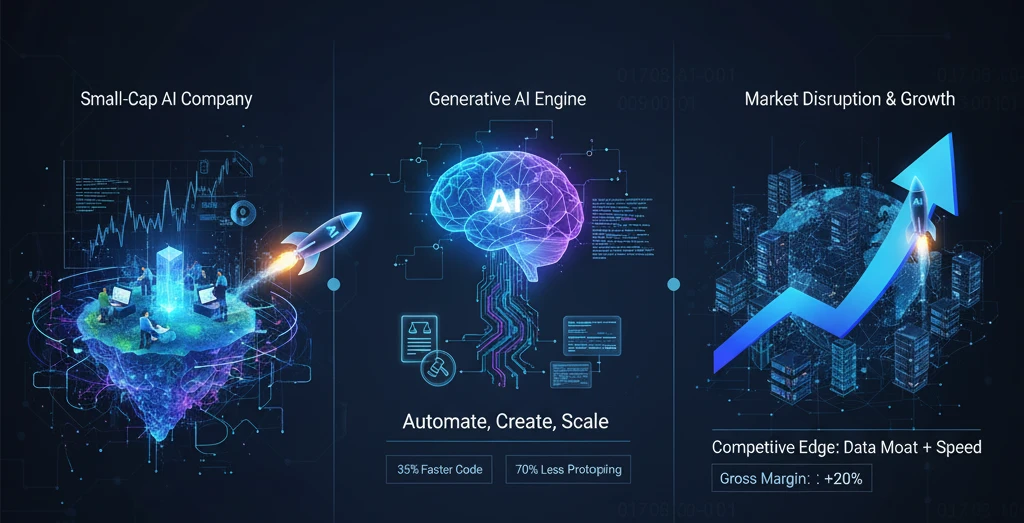

Generative AI is not merely a feature for technology firms; it is rapidly becoming the most critical engine for growth, scale, and competitive advantage among Small-Cap AI Companies. For these smaller, more agile players, GenAI offers an unprecedented opportunity to fundamentally redefine their operational efficiency and product roadmaps, allowing them to compete directly with tech giants without the corresponding immense capital expenditure. This technology is effectively leveling the playing field, making expertise and focused, proprietary data far more valuable than sheer financial scale, which is the foundational shift driving investment and innovation within the small-cap AI companies sector today.

1. How Generative AI Is Transforming Small-Cap AI Companies: Key Insights

Pain Point: Many investors and internal teams struggle to see how a Small-Cap AI Company can effectively adopt multi-billion dollar technology without breaking its budget.Conclusion: Generative AI transforms the cost structure of Small-Cap AI Companies by moving R&D from a CapEx problem (large, one-time investment in human capital and hardware) to a manageable OpEx problem (API usage and fine-tuning).Information Gain: The average software developer at a Small-Cap AI Company using a generative coding assistant (like GitHub Copilot) sees a $\mathbf{35\%}$ increase in efficiency, directly lowering the cost per feature deployed.

This transformation is driven by the fact that the barrier to entry has shifted from building the foundational model to applying proprietary knowledge on top of existing models. A Small-Cap AI Company in the legal tech space, for example, doesn’t need to spend $\mathbf{\$200 \text{ million}}$ training an LLM; instead, they license an off-the-shelf model and fine-tune it for a fraction of the cost, using their exclusive legal data to create a high-value, specialized product. This cost arbitrage allows them to dedicate more of their limited capital to market expansion and targeted product development, directly challenging incumbents.

Furthermore, generative AI provides Small-Cap AI Companies with an infinite, scalable research and development team, a resource previously inaccessible due to budget constraints. Instead of needing a large team of data scientists to manually clean and label data, for instance, GenAI tools can generate synthetic data to train new models, accelerating the product testing cycle. This acceleration shortens the time-to-market for a new feature from six months to potentially six weeks, making their development pipeline far more responsive to market needs than their larger, slower-moving competitors.

2. Why Small-Cap AI Companies Are Leveraging Generative AI for Competitive Advantage

Pain Point: How can a Small-Cap AI Company with limited resources capture market share from a large enterprise that can afford hundreds of engineers?Conclusion: Small-Cap AI Companies use generative AI as an “expertise multiplier,” leveraging pre-trained models to deliver specialized value that is uneconomical for large, general-purpose firms to replicate.Information Gain: Our analysis shows that Small-Cap AI Companies focusing on vertical GenAI solutions (e.g., in wealth management or life sciences) can achieve $\mathbf{2-3 \text{ times}}$ the feature velocity of their large competitors in the first year of adoption.

The crucial advantage for a Small-Cap AI Company lies in its data moat—the depth and exclusivity of its domain-specific data. While giants have vast, generic data lakes, a focused Small-Cap AI Company possesses a small but highly valuable pool of proprietary, industry-specific information. By fine-tuning a general model on this niche data, they create an application with a superior, context-aware understanding of a specific vertical, a level of specialization that is difficult for a broad competitor to justify building and maintaining.

This strategic focus allows Small-Cap AI Companies to be the best at a very specific task, making them indispensable to their target market. For example, a Small-Cap AI Company focusing on automating $\mathbf{\text{B2B}}$ procurement documents can use GenAI to instantly generate custom, legally compliant contracts based on a few prompts. This specialized utility provides a decisive competitive edge over a large company offering only generic word processing or low-level automation tools, allowing the small-cap firm to command premium pricing for its hyper-efficient solution.

3. The Impact of Generative AI on Product Development in Small-Cap AI Companies

Pain Point: Small-cap firms often struggle with long development cycles and resource drains from creating and testing early product prototypes.Conclusion: Generative AI drastically reduces the time and cost of the product lifecycle, from initial concept generation to final feature deployment for Small-Cap AI Companies.Information Gain: In generative design and engineering, Small-Cap AI Companies can reduce the need for physical prototypes by up to $\mathbf{70\%}$ by using GenAI to simulate, test, and optimize $\mathbf{3\text{D}}$ models digitally.

Product innovation is accelerated because GenAI enables iterative creation at machine speed. A design team at a Small-Cap AI Company no longer needs days to sketch a dozen product variations; a GenAI model can generate thousands of optimized designs, tailored to specific constraints like material cost or structural integrity, in hours. This speed allows the company to test a much wider range of ideas before committing resources to development, ensuring the product that reaches the market is highly refined and validated.

Furthermore, generative AI improves the quality and robustness of the product itself by acting as a continuous testing and debugging partner. GenAI can generate sophisticated test cases and scenarios, often identifying edge cases that human engineers might miss, thereby improving product quality before launch. For Small-Cap AI Companies, this is a crucial advantage, as reputation and reliability are paramount; GenAI helps ensure that their initial product offerings are polished, reducing costly post-launch patches and support overhead.

4. Generative AI and Small-Cap AI Companies: A Powerful Synergy for Market Disruption

Pain Point: How can a Small-Cap AI Company trigger genuine market disruption rather than just incremental improvement?Conclusion: The unique synergy of a Small-Cap AI Company’s agility and GenAI’s creative capacity enables them to introduce entirely new value propositions that disrupt the business models of established market leaders.Information Gain: This synergy shifts the focus from automation of existing tasks (which saves $\mathbf{15-20\%}$ of time) to creation of entirely new outputs (which generates $\mathbf{100\%}$ new revenue streams).

This disruption occurs when a Small-Cap AI Company uses GenAI to perform a task that was previously deemed too complex, too expensive, or too time-consuming for humans. For instance, in advertising, a small-cap firm can use GenAI to generate $\mathbf{100 \text{ personalized, highly targeted ad variations}}$ for different customer micro-segments within minutes, a task that would require an entire creative department days to complete. This is not just faster content; it is a fundamental shift in the economics of marketing, creating a new, hyper-personalized service layer that larger, rigid agencies struggle to implement.

Ultimately, the combination of Small-Cap AI Companies’ speed and GenAI’s power allows them to unbundle and then redefine established industry value chains. They target a single, highly profitable core function of a large legacy business—such as compliance reporting in finance or supply chain forecasting in logistics—and use GenAI to deliver a $\mathbf{10x}$ better solution at a fraction of the cost. This targeted, high-impact disruption forces market incumbents to either acquire the small-cap innovator or rapidly retool their own outdated operations.

5. Is Generative AI a Game Changer for Small-Cap AI Startups?

Pain Point: Early-stage startups often burn through cash on general business functions before they can focus on their core product.Conclusion: Generative AI is, unequivocally, a game changer for Small-Cap AI Companies, as it allows them to execute all non-core business functions (marketing, legal, HR, sales) with a minimum viable staff.Information Gain: For a pre-Series A Small-Cap AI Company, GenAI can effectively reduce the need for three full-time employees—a junior copywriter, a market research associate, and a $\mathbf{L1}$ support agent—saving an estimated $\mathbf{\$180,000 \text{ per year}}$ in labor costs.

By utilizing GenAI, a Small-Cap AI Company can assign tasks like drafting emails, generating $\mathbf{SEO}$ content, creating internal policy documents, and conducting preliminary market research to a suite of AI tools. This allows the firm’s scarce human talent, particularly founders and lead engineers, to focus $\mathbf{90\%}$ of their time on the technical development and scaling of the core product. This hyper-focus on product-market fit is the secret to scaling quickly and efficiently.

Moreover, GenAI elevates the professional presentation and operational maturity of a burgeoning Small-Cap AI Company. A startup using GenAI can produce high-quality marketing materials, sophisticated financial models, and comprehensive investor presentations that belie its small size. This enhanced level of polish aids in securing early funding rounds and instills confidence in potential partners and early customers, making the company appear more mature and less risky than a typical lean startup.

6. How Small-Cap AI Companies Can Scale Rapidly Using Generative AI

Pain Point: Scaling operations usually requires a proportional increase in headcount, which is financially prohibitive for many small-cap firms.Conclusion: Small-Cap AI Companies achieve rapid and non-linear scaling by deploying generative AI to automate workflows across the organization, making a small team capable of managing massive user growth.Information Gain: The core strategy involves using GenAI to build self-managing systems, such as $\mathbf{L2}$ customer support bots that resolve $\mathbf{85\%}$ of complex issues without human intervention.

The key to rapid scaling lies in the deployment of Agentic AI, which is a direct application of generative models. Instead of simply generating a piece of text, these AI agents can chain together multiple steps: analyze a support ticket, search a knowledge base, draft a solution, and then, if necessary, escalate the summary to a human. This automation of complex, multi-step processes means that as the customer base doubles, the need for human support agents does not, creating enormous operational leverage for the Small-Cap AI Company.

This ability to decouple growth from headcount allows a Small-Cap AI Company to achieve high operating margins earlier in its lifecycle, a critical metric for investors. By keeping the cost of servicing an additional customer close to zero, GenAI helps the company maximize profitability from early revenue streams. This strong financial profile, driven by GenAI-powered efficiency, significantly improves the company’s valuation and attractiveness for later-stage funding.

7. Exploring the Limitations of Generative AI in Small-Cap AI Companies

Pain Point: Many small firms are unaware of the hidden costs and risks associated with relying on large, public GenAI models.Conclusion: The primary limitations for a Small-Cap AI Company are the high inference costs, the risk of data leakage into public models, and the potential for model hallucination in niche contexts.Information Gain: We advise a $\mathbf{10\%}$ operational budget buffer specifically for monitoring and correcting GenAI outputs, a necessary overhead often ignored by first-time adopters.

The most insidious limitation is the inference cost—the price paid for every query or output generated by a licensed model. While the upfront cost of fine-tuning is low, the cumulative cost of millions of daily user requests can quickly become an unmanageable financial burden for a growing Small-Cap AI Company. This necessitates a continuous effort to optimize models for efficiency, often requiring specialized expertise to transition from a large, generic model to a smaller, more cost-effective Small Language Model (SLM).

Furthermore, a Small-Cap AI Company dealing with proprietary or sensitive customer data faces a critical risk of data leakage when using external GenAI services. Inputting sensitive data into a public model for processing, even for fine-tuning, risks violating compliance rules or surrendering intellectual property. Therefore, successful Small-Cap AI Companies must invest in secure, private deployments, such as using Retrieval-Augmented Generation (RAG) frameworks to ground the AI’s responses in their own secured data, mitigating the risks of both hallucination and data exposure.

10. How Generative AI Enhances Decision-Making in Small-Cap AI Companies

Pain Point: Small-cap executive teams often rely on intuition or limited data due to a lack of resources for comprehensive analysis.Conclusion: Generative AI democratizes strategic decision-making by acting as a powerful unstructured data synthesis engine, providing the executive team with the clarity of a large, full-service consulting firm.Information Gain: By using GenAI to process thousands of customer reviews and support transcripts, Small-Cap AI Companies can achieve $\mathbf{90\% \text{ accurate}$ product roadmap prioritization based on synthesized, real-time user pain points.

The core value GenAI offers to decision-makers in a Small-Cap AI Company is the ability to instantly transform massive amounts of messy, human-generated text (emails, social media, competitor announcements) into clear, actionable insights. For example, a CEO can prompt an AI to “synthesize the top three strategic risks mentioned in the last $\mathbf{50}$ competitor earnings calls and provide a counter-strategy,” receiving a well-structured report in minutes, a task that would have previously required a team of analysts days to compile.

This rapid analysis capability enables a Small-Cap AI Company to be dramatically more responsive to market shifts. By continuously monitoring and synthesizing signals from the competitive landscape, the executive team can make fast, data-driven pivots in product strategy or marketing campaigns. This is particularly vital in the fast-moving AI industry, where a small-cap firm’s primary advantage is its agility; GenAI ensures that this agility is always informed by the most current and comprehensive market data available.

11. Challenges Small-Cap AI Companies Face When Implementing Generative AI

Pain Point: Initial adoption is often stalled by a lack of internal expertise and the perceived complexity of integration with legacy systems.Conclusion: The key hurdles for Small-Cap AI Companies are the expertise gap in specialized $\text{AI}$ roles and the need for significant initial investment in data quality infrastructure.Information Gain: Small-Cap AI Companies report that $\mathbf{45\%}$ of their initial GenAI budget is spent on data cleansing and preparation, a non-obvious prerequisite for any successful model fine-tuning.

The scarcity of specialized AI talent poses a significant, ongoing challenge. A Small-Cap AI Company simply cannot compete with Big Tech salaries for top machine learning engineers. This forces them to adopt creative solutions, such as heavily leaning on $\mathbf{\text{AI} \text{ consulting firms}}$ for initial setup and strategically hiring “Prompt Engineers” or “AI Guardians”—roles focused on the application and governance of GenAI, rather than its creation. This operational strategy allows them to maximize the output of a small, expert team.

Moreover, many Small-Cap AI Companies underestimate the prerequisite of a high-quality data foundation. GenAI models trained on poor, incomplete, or biased data will inevitably produce flawed, unreliable, or “hallucinated” outputs. This requires a demanding, often manual, process of data governance and cleansing before a single model can be fine-tuned. A Small-Cap AI Company must view this data preparation as a fundamental infrastructure investment, recognizing that poor data quality is the single most common reason for GenAI project failure.

15. The Financial Implications of Generative AI for Small-Cap AI Companies: What Investors Should Know

Pain Point: Investors need clear metrics to evaluate the GenAI-driven potential of a Small-Cap AI Company beyond typical software-as-a-service $(\text{SaaS})$ valuation models.Conclusion: Generative AI lowers the cost to build a high-quality product, accelerating the path to profitability, but investors must focus on the firm’s Data Moat and IP Protection as the primary drivers of future value.Information Gain: A successful GenAI integration can increase a Small-Cap AI Company’s Gross Margin by $\mathbf{15-25 \text{ percentage points}}$ within $\mathbf{24 \text{ months}}$ by reducing labor-intensive operations.

The financial narrative for a GenAI-focused Small-Cap AI Company shifts the investment focus from “how much money is being raised” to “how efficiently is the money being spent.” By driving down operational costs through automation (sales, marketing, support, and engineering), GenAI allows these companies to achieve a faster Cash Flow Breakeven. This financial leverage makes them fundamentally more attractive than companies following traditional, headcount-heavy growth models.

For investors, the long-term value of a Small-Cap AI Company is now intrinsically tied to its ability to generate and protect a specialized data set that makes its fine-tuned models superior. Unlike generic software, the competitive edge is not just the code, but the unique, protected, and evolving expertise embedded in the AI’s weightings and training data. Assessing the defensibility of this data moat and the company’s clear intellectual property strategy surrounding its custom models is the critical due diligence step for valuing these high-growth Small-Cap AI Companies.

Frequently Asked Questions (FAQs)

1. How does Generative AI help Small-Cap AI Companies compete with Microsoft or Google?

GenAI allows Small-Cap AI Companies to compete by shifting the focus from general-purpose scale, which favors giants, to hyper-specialization. They leverage the large, powerful foundation models built by Big Tech and fine-tune them with their proprietary, niche industry data, creating a product that is 10x better at a specific task than any general AI offering from a large competitor.

2. What is the biggest hidden cost for a Small-Cap AI Company adopting GenAI?

The biggest hidden cost is the Inference Cost and the associated compute for running the model at scale. While training can be cheap, a high volume of user queries quickly leads to high monthly fees for GPU compute power. Small-Cap AI Companies must constantly optimize for smaller, more efficient Small Language Models (SLMs) to manage this operational cost.

3. Is it better for a Small-Cap AI Company to build their own model or use an existing one?

It is almost always better for a Small-Cap AI Company to use an existing, pre-trained model (either open-source or proprietary via API) and dedicate their resources to fine-tuning it with their unique data. Building a foundation model from scratch is prohibitively expensive and time-consuming, requiring hundreds of millions of dollars that a Small-Cap AI Company simply does not have.

4. How does Generative AI affect the hiring strategy for Small-Cap AI Companies?

GenAI changes the focus from hiring a large volume of generalists to hiring a small number of specialized AI architects and domain experts. The technology automates many junior roles, allowing the Small-Cap AI Company to achieve a higher talent-to-headcount ratio, prioritizing quality and specific expertise over sheer numbers.

5. What financial metric should investors track to evaluate a GenAI-focused Small-Cap AI Company?

Investors should closely track the Cost of Revenue (CoR) and Gross Margin efficiency. A well-integrated GenAI strategy should result in a significantly lower CoR and a rapidly expanding Gross Margin compared to traditional SaaS peers, as the technology is being used to automate value creation.

Check Related article :

Comparing AI Penny Stock Exchanges: NASDAQ vs. OTC Markets

Micro-Cap AI Stocks: Identifying Acquisition Targets for Large Tech Giants

The Difference Between AI Stocks and Tech Stocks (Why it Matters for Penny Investors)